Conversely, fewer actual hours than standard would denote improved efficiency and cost savings. Labor efficiency variance, also referred to as labor time variance, constitutes a segment of the broader labor cost variance. This variance emerges from the disparity between the anticipated standard labor hours and the actual hours expended. Its core function lies in quantifying this difference, providing insight into whether a business optimally leverages its labor force.

Direct Labor Yield Variance

It mirrors the concept of the materials usage variance in tracking resource utilization against predetermined benchmarks. This variance assessment offers critical insights into operational efficiency and resource allocation within a business framework. As with direct materials variances, all positive variances areunfavorable, and all negative variances are favorable. Even though the answer is a negative number, the variance is favorable because employees worked more efficiently, saving the organization money. What we have done is to isolate the cost savings from our employees working swiftly from the effects of paying them more or less than expected. The Purple Fly has experienced a favorable direct labor efficiency variance of $219 during the second quarter of operations because its workers were able to finish 1,200 units in fewer hours (3,780) than the hours allowed by standards (3,840).

Managerial Accounting

Possible causes of an unfavorable efficiency variance include poorly trained workers, poor quality materials, faulty equipment, and poor supervision. Another important reason of an unfavorable labor efficiency variance may be insufficient demand for company’s products. One significant hurdle lies in the complexity of establishing accurate standards for labor hours, requiring a deep dive into historical data, process intricacies, and industry benchmarks, often susceptible to subjective interpretation. The labor efficiency variance calculation presented previouslyshows that 18,900 in actual hours worked is lower than the 21,000budgeted hours. Clearly, this is favorable since theactual hours worked was lower than the expected (budgeted)hours.

What is your current financial priority?

In such cases, the negative variance indicates lower efficiency, as more time than expected was needed to complete the work. We have demonstrated how important it is for managers to beaware not only of the cost of labor, but also of the differencesbetween budgeted labor costs and actual labor costs. This awarenesshelps managers make decisions that protect the financial health oftheir companies.

- The purpose of calculating the direct labor efficiency variance is to measure the performance of the production department in utilizing the abilities of the workers.

- Lynn was surprised tolearn that direct labor and direct materials costs were so high,particularly since actual materials used and actual direct laborhours worked were below budget.

- The management estimate that 2000 hours should be used for packing 1000 kinds of cotton or glass.

- If however, it is considered to be significant in relation to the size of the business, then the variance needs to be analyzed between the inventory accounts (work in process, and finished goods) and the cost of goods sold account.

The purpose of calculating the direct labor efficiency variance is to measure the performance of the production department in utilizing the abilities of the workers. A positive value of direct labor efficiency variance is obtained when the standard direct labor hours allowed exceeds the actual direct labor hours used. A negative value of direct labor efficiency variance means that excess direct labor hours have been used in production, implying that the labor-force has under-performed. An unfavorable labor efficiency variance signifies that more labor hours were expended than the predetermined standard for the production achieved. It indicates decreased efficiency, where the actual hours surpass the anticipated ones, potentially leading to higher labor costs and inefficiencies within the production process. The direct labor efficiency variance is one of the main standard costing variances, and results from the difference between the standard quantity and the actual quantity of labor used by a business during production.

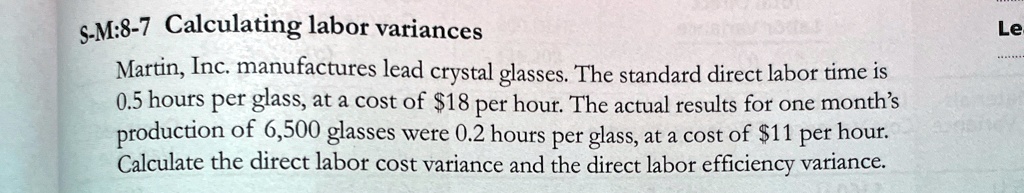

The other two variances that are generally computed for direct labor cost are the direct labor efficiency variance and direct labor yield variance. For Jerry’s Ice Cream, the standard allows for 0.10labor hours per unit of production. Thus the 21,000 standard hours(SH) is 0.10 hours per unit × 210,000 units produced. This shows that our labor costs are over budget, but that our employees differences between irs form 940 form 941 and form 944 are working faster than we expected. Direct Labor Efficiency Variance is the measure of difference between the standard cost of actual number of direct labor hours utilized during a period and the standard hours of direct labor for the level of output achieved. The direct labor (DL) variance is the difference between the total actual direct labor cost and the total standard cost.

On the other hand, LEV gauges the variance arising from differences in actual and standard hours worked, focusing on productivity changes. Essentially, labor rate variance addresses wage-related costs, while labor efficiency variance assesses the impact of productivity variations on labor costs. Recall from Figure 10.1 that the standard rate for Jerry’s is$13 per direct labor hour and the standard direct labor hours is0.10 per unit. Figure 10.6 shows how to calculate the labor rateand efficiency variances given the actual results and standardsinformation.

If the company fails to control the efficiency of labor, then it becomes very difficult for the company to survive in the market. The actual results show that the packing department worked 2200 hours while 1000 kinds of cotton were packed. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.